更多有关于 “ 区块链 ” 的文章,请点击这里。

| The technology behind bitcoin lets people who do not know or trust each other build a dependable ledger. This has implications far beyond the cryptocurrency. |

| 比特币背后的技术可以让互不认识或互不信任对方的人们建立一个可靠的账本。这远远超出了加密货币的含义。 |

WHEN the Honduran police came to evict her in 2009 Mariana Catalina Izaguirre had lived in her lowly house for three decades. Unlike many of her neighbours in Tegucigalpa, the country’s capital, she even had an official title to the land on which it stood. But the records at the country’s Property Institute showed another person registered as its owner, too—and that person convinced a judge to sign an eviction order. By the time the legal confusion was finally sorted out, Ms Izaguirre’s house had been demolished.

Mariana Catalina Izaguirre 女士在她简陋的房子里已经居住了三十年,但洪都拉斯的警察在 2009 年突然要将她赶走。不同于她在特古西加尔巴的许多邻居(特古西加尔巴是洪都拉斯的首都),她其实拥有所居住房子的土地凭证。但国家产权局的记录显示,另一个人也登记了这个房子,于是那人说服法官申请驱逐令。虽然法院最后终于弄清楚房屋的真正所有者就是 Izaguirre 女士,但 Izaguirre 女士的房子已经被拆毁了。

It is the sort of thing that happens every day in places where land registries are badly kept, mismanaged and/or corrupt—which is to say across much of the world. This lack of secure property rights is an endemic source of insecurity and injustice. It also makes it harder to use a house or a piece of land as collateral, stymying investment and job creation.

由于土地登记处的信息记录随意、管理不善甚至腐败,使得类似的事情每天都在这些地方发生 —— 可以说全世界许多地方都这样。财产权缺乏保障是不安全和不公平的普遍根源。这也使得很难用一套房子或一块土地作为抵押(来贷款),这将阻碍投资和创造就业的机会。

Such problems seem worlds away from bitcoin, a currency based on clever cryptography which has a devoted following among mostly well-off, often anti-government and sometimes criminal geeks. But the cryptographic technology that underlies bitcoin, called the “blockchain”, has applications well beyond cash and currency. It offers a way for people who do not know or trust each other to create a record of who owns what that will compel the assent of everyone concerned. It is a way of making and preserving truths.

这些问题似乎远离比特币(或比特币似乎能很好地解决这些问题),比特币是基于巧妙的加密算法的数字货币,它在大多数有钱人、反政府人士和偶尔犯罪的极客当中都拥有忠实的追随者。奠定比特币的加密技术被称为 “ 区块链 ” ,区块链的具体应用远远超出现金和货币的范畴。它为那些互不认识或互不信任的人提供了一种途径,让他们创建一个记录,记录下谁拥有哪些东西并迫使有关各方同意。这是一种创造和保护真理的方式(或它是真理的创造者和捍卫者)。

That is why politicians seeking to clean up the Property Institute in Honduras have asked Factom, an American startup, to provide a prototype of a blockchain-based land registry. Interest in the idea has also been expressed in Greece, which has no proper land registry and where only 7% of the territory is adequately mapped.

这就是那些寻求清理洪都拉斯产权局的政客们请求美国初创公司 —— Factom 来提供基于区块链技术的土地登记雏形的原因。希腊也表达了对这一想法的兴趣,希腊没有合理的土地登记,全国只有 7 % 的土地拥有适当地测绘(或正确的记录)。

A place in the past

Other applications for blockchain and similar “distributed ledgers” range from thwarting diamond thieves to streamlining stockmarkets: the NASDAQ exchange will soon start using a blockchain-based system to record trades in privately held companies. The Bank of England, not known for technological flights of fancy, seems electrified: distributed ledgers, it concluded in a research note late last year, are a “significant innovation” that could have “far-reaching implications” in the financial industry.

之前的一些应用

区块链和类似的 “ 分布式账本 ” 的其它应用,从挫败钻石窃贼到精简股票市场都有用武之地:纳斯达克交易所很快将开始启用基于区块链技术的股权交易平台,来记录私营公司的交易。英格兰银行( Ricky 注:英格兰银行是英国的中央银行)向来不爱接纳新兴科技,但这次似乎也有所触动:去年年底,该银行在一份研究报告中总结道,分布式账本是一项 “ 重大创新 ” ,可能对金融业产生 “ 深远的影响 ” 。

The politically minded see the blockchain reaching further than that. When co-operatives and left-wingers gathered for this year’s OuiShare Fest in Paris to discuss ways that grass-roots organisations could undermine giant repositories of data like Facebook, the blockchain made it into almost every speech. Libertarians dream of a world where more and more state regulations are replaced with private contracts between individuals—contracts which blockchain-based programming would make self-enforcing.

有政治头脑的人认为区块链的发展远不止于此。今年巴黎 OuiShare Fest 会议上( OuiShare Fest 是全球一年一度的经济合作会议),合作伙伴和左翼分子共聚一堂,在他们谈到基层组织如何撼动像 Facebook 这样巨大的数据库时,区块链话题贯穿了会议的全程(或几乎每个演讲都谈到了区块链)。自由主义者梦想全世界会有越来越多的政府法规能被个体之间的私人合约所取代 —— 这些合约基于区块链来编程,并能够自动执行( Ricky 注:也就是智能合约)。

The blockchain began life in the mind of Satoshi Nakamoto, the brilliant, pseudonymous and so far unidentified creator of bitcoin—a “purely peer-to-peer version of electronic cash”, as he put it in a paper published in 2008. To work as cash, bitcoin had to be able to change hands without being diverted into the wrong account and to be incapable of being spent twice by the same person. To fulfil Mr Nakamoto’s dream of a decentralised system the avoidance of such abuses had to be achieved without recourse to any trusted third party, such as the banks which stand behind conventional payment systems.

区块链是在中本聪的头脑中酝酿出来的,他是出色的、使用笔名的、迄今为止身份不明的比特币创造者,比特币是 “ 一种点对点的电子现金系统 ” ,他在 2008 年发表了这篇论文。比特币要像现金一样运作起来,就必须能够在不转入错误账户的情况下换手(或转账),还要杜绝双重支付的问题( Ricky 注:所谓双重支付的问题就是同一个人持有的比特币不能在同一时间的不同地方使用)。为了实现中本聪去中心化系统的愿景,必须要在不依赖任何可信任第三方(比如支撑传统支付系统的银行)的情况下避免上述一类的滥用。

It is the blockchain that replaces this trusted third party. A database that contains the payment history of every bitcoin in circulation, the blockchain provides proof of who owns what at any given juncture. This distributed ledger is replicated on thousands of computers—bitcoin’s “nodes”—around the world and is publicly available. But for all its openness it is also trustworthy and secure. This is guaranteed by the mixture of mathematical subtlety and computational brute force built into its “consensus mechanism”—the process by which the nodes agree on how to update the blockchain in the light of bitcoin transfers from one person to another.

取代可信任第三方的正是区块链。区块链是一个包含了每个流通中的比特币的交易历史的数据库,它提供了在任何特定时刻谁拥有什么的证据。这种分布式账簿在成千上万的计算机中复制 —— 比特币 “ 节点 ” —— 在全世界范围内都是公开可用的。但尽管如此,它的开放性也是值得信赖和安全的。这是由巧妙的数学算法和强大的计算机算力混合在一起组成的 “ 共识机制 ” 所保证的 —— 在此过程中节点将就如何根据交易信息(比特币从一个人转移到另一个人即为交易)更新区块链达成一致。

Let us say that Alice wants to pay Bob for services rendered. Both have bitcoin “wallets”—software which accesses the blockchain rather as a browser accesses the web, but does not identify the user to the system. The transaction starts with Alice’s wallet proposing that the blockchain be changed so as to show Alice’s wallet a little emptier and Bob’s a little fuller.

举个例子,Alice 要向 Bob 支付劳务费。两人都有比特币 “ 钱包 ” —— 这是访问区块链的软件,而不是访问网页的浏览器,但这个软件不能够识别系统中的用户( Ricky 对这句的理解是可实现匿名交易)。交易从 Alice 的钱包开始,钱包提议更改区块链,最终(被更改的区块链)会显示 Alice 的钱包余额减少,而 Bob 的钱包余额增多。

The network goes through a number of steps to confirm this change. As the proposal propagates over the network the various nodes check, by inspecting the ledger, whether Alice actually has the bitcoin she now wants to spend. If everything looks kosher, specialised nodes called miners will bundle Alice’s proposal with other similarly reputable transactions to create a new block for the blockchain.

网络会经过几个步骤来确认这种改变。随着提案在全网广播,各个不同的节点会通过检测账簿确认 Alice 是否真的拥有她现在想要消费的比特币。如果这一切看起来都是合规的,那么称为矿工的专业节点( Ricky 注:矿工负责维护比特币网络的正常运转)会将 Alice 和其它类似的可信的交易打包在一起,并为区块链创建一个新的区块(或并将其写进区块链的新区块中)。

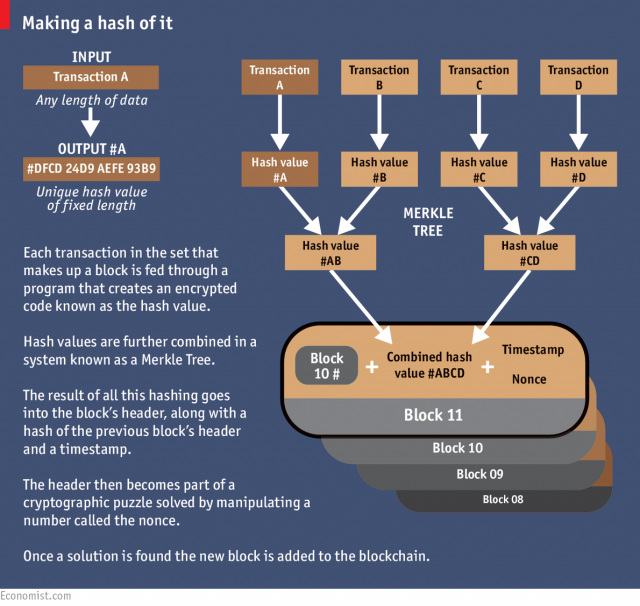

This entails repeatedly feeding the data through a cryptographic “hash” function which boils the block down into a string of digits of a given length (see diagram). Like a lot of cryptography, this hashing is a one-way street. It is easy to go from the data to their hash; impossible to go from the hash back to the data. But though the hash does not contain the data, it is still unique to them. Change what goes into the block in any way—alter a transaction by a single digit—and the hash would be different.

这需要不断地将数据输入到一个加密的 “ 哈希 ” 函数中,该函数将区块分解为一个给定长度的数字串(如上图所示)。像许多密码学算法一样,这种散列计算是单向的。从数据中推算出对应的散列值是很容易的,但从散列值反过来推算出数据是不可能的。虽然散列值不包含数据内容,但每个散列值都是独一无二的。以任何方式更改进入区块中的内容 —— 如更改某笔交易中的一个数字 —— 对应的散列值都会随之不同。

Running in the shadows

That hash is put, along with some other data, into the header of the proposed block. This header then becomes the basis for an exacting mathematical puzzle which involves using the hash function yet again. This puzzle can only be solved by trial and error. Across the network, miners grind through trillions and trillions of possibilities looking for the answer. When a miner finally comes up with a solution other nodes quickly check it (that’s the one-way street again: solving is hard but checking is easy), and each node that confirms the solution updates the blockchain accordingly. The hash of the header becomes the new block’s identifying string, and that block is now part of the ledger. Alice’s payment to Bob, and all the other transactions the block contains, are confirmed.

在阴暗处运行

该散列值将和其它一些数据一起放入所提议的区块的头部中( header )。这个头部紧接着会成为一个需要付出极大努力才能破解的数学难题的基础,它需要再次使用到散列函数。这个难题只有通过不断的试错才能被解出。在整个网络中,矿工们要在数以万亿计的可能性中寻找答案。当一个矿工最终找到了答案,其它节点就会快速对它进行检查(这过程也是单向的:解题困难,但检查容易),并且确认了难题答案的每个节点会相应地更新区块链。区块头的散列值成为新区块的标识字符串,随之该区块就会成为账簿的一部分。Alice 对 Bob 的付款,以及该区块包含的其它所有的交易,都将得到确认( Ricky 注:因为该区块已经被其他节点确认并成为了区块链中新的一环,所以此时该区块包含的所有交易都是有效的了)。

This puzzle stage introduces three things that add hugely to bitcoin’s security. One is chance. You cannot predict which miner will solve a puzzle, and so you cannot predict who will get to update the blockchain at any given time, except in so far as it has to be one of the hard working miners, not some random interloper. This makes cheating hard.

这个解题阶段介绍了三样能够大大增加比特币安全性的东西(或概念)。第一个是偶然性:你无法预测到哪个矿工能解出难题,因此你无法预测到谁能在任意特定时间更新区块链,除非它是一个努力工作的矿工,而不是某个随机的闯入者。这让作弊变得异常困难。

The second addition is history. Each new header contains a hash of the previous block’s header, which in turn contains a hash of the header before that, and so on and so on all the way back to the beginning. It is this concatenation that makes the blocks into a chain. Starting from all the data in the ledger it is trivial to reproduce the header for the latest block. Make a change anywhere, though—even back in one of the earliest blocks—and that changed block’s header will come out different. This means that so will the next block’s, and all the subsequent ones. The ledger will no longer match the latest block’s identifier, and will be rejected.

第二个是历史。每个新的头部都会包含上一个区块的头部的散列值,上一个头部也会包含上上一个头部的散列值,以此类推,一直到开头。正是这种相互连接使区块串起成为链。从整个区块链的创世块开始再次推算出最新区块的头部是易如反掌的事( Ricky 注:即对整个区块链从头到尾进行一遍检查是很容易的)。尽管如此,在任意地方进行更改 —— 即使回到最早的某个区块中 —— 更改后的区块的头部也会出现不同的结果( Ricky 注:如果某个区块被修改过了,那么经过散列运算得到的散列值跟原来的散列值肯定是不一样的)。这意味着下一个区块,和连同后续所有的区块都是如此( Ricky 注:即后续块的头部跟原来的头部也完全不同了,因为上一个头部也会包含上上一个头部的散列值)。这个账簿(或这个被改动过的区块链)将不再匹配最新区块的标识符,并将被拒绝。

Ricky 注:如需详细了解比特币或者比特币中的区块链技术是如何工作的,还请先阅读比特币白皮书。

Is there a way round this? Imagine that Alice changes her mind about paying Bob and tries to rewrite history so that her bitcoin stays in her wallet. If she were a competent miner she could solve the requisite puzzle and produce a new version of the blockchain. But in the time it took her to do so, the rest of the network would have lengthened the original blockchain. And nodes always work on the longest version of the blockchain there is. This rule stops the occasions when two miners find the solution almost simultaneously from causing anything more than a temporary fork in the chain. It also stops cheating. To force the system to accept her new version Alice would need to lengthen it faster than the rest of the system was lengthening the original. Short of controlling more than half the computers—known in the jargon as a “51% attack”—that should not be possible.

是否有办法扭转这个局面?试想一下,Alice 突然改变给 Bob 付款的主意,并试图重写历史,使她的比特币仍然停留在钱包里。如果她是有能力(这么做)的矿工,她要解决(上文提到的)必要的难题并产生新版本的区块链(以取消她对 Bob 的支付)。但她这样做的时候,其他网络(或其他节点)仍会继续延长原来的区块链。节点总是在最长版本的区块链上工作。当两个矿工几乎同时解答出难题时,这条规则避免了区块链出现临时分叉以外的任何情况的发生,并且还可以杜绝作弊。 为了迫使系统(或其他节点)接受她的新版本,Alice 延长区块链的速度需要比其他系统(或其他节点)延长原来的区块链的速度更快。(为了让其他节点接受她的区块链)短时间内需要控制一半以上的计算机 —— 在行内这被称为 “ 51 % 攻击 ” —— 那应该是不可能的。

Dreams are sometimes catching

Leaving aside the difficulties of trying to subvert the network, there is a deeper question: why bother to be part of it at all? Because the third thing the puzzle-solving step adds is an incentive. Forging a new block creates new bitcoin. The winning miner earns 25 bitcoin, worth about $7,500 at current prices.

梦想有时会实现

抛开试图颠覆网络的困难,还有一个更深层次的问题:为何要成为其中的一员呢?因为解题步骤增加的第三件事是激励。锻造(或生成)一个新的区块会产生新的比特币。胜出的矿工可以赚得 25 个比特币,按目前的价格计算,价值约 7,500 美元。

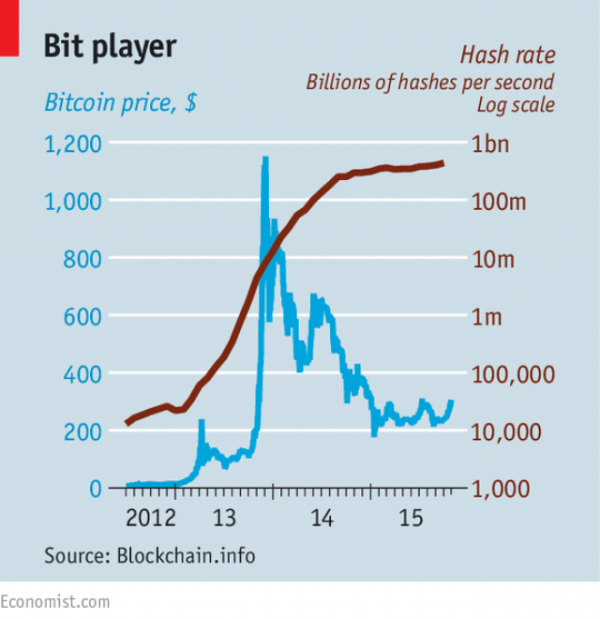

All this cleverness does not, in itself, make bitcoin a particularly attractive currency. Its value is unstable and unpredictable (see chart), and the total amount in circulation is deliberately limited. But the blockchain mechanism works very well. According to blockchain.info, a website that tracks such things, on an average day more than 120,000 transactions are added to the blockchain, representing about $75m exchanged. There are now 380,000 blocks; the ledger weighs in at nearly 45 gigabytes.

所有这些聪明的想法并不能使比特币成为一种特别有吸引力的货币。它的价值是不稳定的和不可预测的(如下图所示),并且流通的总量也是被刻意限制的。但是区块链机制运作得非常良好。根据 blackchain.info 网站提供的信息,这是一个追踪此类事件的(或追踪区块链动态的)网站,平均每天有超过 120,000 笔交易被写入到区块链中,交易金额约为 7,500 万美元。现在有 380,000 个区块,账簿占用接近 45 GB 的空间。

Most of the data in the blockchain are about bitcoin. But they do not have to be. Mr Nakamoto has built what geeks call an “open platform”—a distributed system the workings of which are open to examination and elaboration. The paragon of such platforms is the internet itself; other examples include operating systems like Android or Windows. Applications that depend on basic features of the blockchain can thus be developed without asking anybody for permission or paying anyone for the privilege. “The internet finally has a public data base,” says Chris Dixon of Andreessen Horowitz, a venture-capital firm which has financed several bitcoin start-ups, including Coinbase, which provides wallets, and 21, which makes bitcoin-mining hardware for the masses.

区块链中的大部分数据是关于比特币的,但它们并不一定是。中本聪先生已经建成了极客所谓的 “ 开放平台 ” —— 一种工作方式可供审查和推敲的分布式系统。这种平台的典范就是互联网本身;其它例子如操作系统有 Android 和 Windows 。因此,依赖于区块链基本特性的应用程序可以在无需向任何人请求许可或向任何人购买特权的情况下开发出来。“ 互联网终于有了一个公开的数据库,” 风险投资公司 Andreessen Horowitz 负责人 Chris Dixon 这样说到,该公司已经资助了几家比特币初创公司,包括钱包提供商 Coinbase 和为大众生产比特币挖矿硬件(即比特币矿机)的 21 公司。

For now blockchain-based offerings fall in three buckets. The first takes advantage of the fact that any type of asset can be transferred using the blockchain. One of the startups betting on this idea is Colu. It has developed a mechanism to “dye” very small bitcoin transactions (called “bitcoin dust”) by adding extra data to them so that they can represent bonds, shares or units of precious metals.

现在以区块链为基础的产品分为三类。第一类是利用了可以使用区块链转移任何类型的资产的事实。把赌注押在这个想法上的一家初创公司是 Colu ,它已开发出可 “ 沾染 ” 非常小的比特币交易的机制(称为 “ 比特币尘埃 ” ),通过 “ 比特币尘埃 ” 向它们(即比特币交易)添加额外数据来使它们代表债券、股票或贵金属单位。

Protecting land titles is an example of the second bucket: applications that use the blockchain as a truth machine. Bitcoin transactions can be combined with snippets of additional information which then also become embedded in the ledger. It can thus be a registry of anything worth tracking closely. Everledger uses the blockchain to protect luxury goods; for example it will stick on to the blockchain data about a stone’s distinguishing attributes, providing unchallengeable proof of its identity should it be stolen. Onename stores personal information in a way that is meant to do away with the need for passwords; CoinSpark acts as a notary. Note, though, that for these applications, unlike for pure bitcoin transactions, a certain amount of trust is required; you have to believe the intermediary will store the data accurately.

保护土地所有权是第二个分类。使用区块链的应用程序可视为真理机器。比特币交易可以与附加信息片段结合在一起,再被嵌入到账簿中。因此它可以用作任何值得细致追踪的事物的登记表。Everledger 使用区块链保护奢侈物品;举个例子,它会把该物品的一些不可更改的独特属性 “ 系在 ” 区块链数据上,如果它被偷了,将提供一种无可辩驳的身份证明。Onename 以一种不需要密码(验证)的方式存储个人信息;CoinSpark 充当公证人等。不过请注意,这些应用不同于纯粹的比特币交易,还需要一定程度的信任;(因为)你必须相信这些中介能正确地存储数据。

It is the third bucket that contains the most ambitious applications: “smart contracts” that execute themselves automatically under the right circumstances. Bitcoin can be “programmed” so that it only becomes available under certain conditions. One use of this ability is to defer the payment miners get for solving a puzzle until 99 more blocks have been added—which provides another incentive to keep the blockchain in good shape.

第三个分类包含了最雄心勃勃的应用:能在正常情况下自动执行的 “ 智能合约 ” 。比特币是 “ 可被编程的 ” ,因此在某些特定条件下它可大展身手。这种能力的一个用途是在超过 99 个区块被添加后才向矿工延期支付他们解出难题的奖励 —— 这为保持区块链的良好状态提供了另一种激励。

Lighthouse, a project started by Mike Hearn, one of bitcoin’s leading programmers, is a decentralised crowdfunding service that uses these principles. If enough money is pledged to a project it all goes through; if the target is never reached, none does. Mr Hearn says his scheme will both be cheaper than non-bitcoin competitors and also more independent, as governments will be unable to pull the plug on a project they don’t like.

比特币资深程序员 Mike Hearn 启动了一个名为 “ 灯塔 ” 的项目,它是一个使用这些规则(即智能合约)的分布式众筹服务。如果有足够的资金投入到一个项目中,该项目就顺利开始;如果未达目标,该项目就停止。Hearn 表示他的解决方案不仅比非比特币的竞争对手便宜,而且更独立,因为政府将无法关闭他们不喜欢的项目。

Energy is contagious

The advent of distributed ledgers opens up an “entirely new quadrant of possibilities”, in the words of Albert Wenger of USV, a New York venture firm that has invested in startups such as OpenBazaar, a middleman-free peer-to-peer marketplace. But for all that the blockchain is open and exciting, sceptics argue that its security may yet be fallible and its procedures may not scale. What works for bitcoin and a few niche applications may be unable to support thousands of different services with millions of users.

能源(消耗)在迅速蔓延

借用 USV 的 Albert Wenger 的话说,分布式账簿的出现开启了一片 “ 未知的全新领域 ” ,USV 是一家纽约风险投资公司,该公司已经投资了诸如 OpenBazaar 这样的初创公司,OpenBazaar 是一个没有中间人的点对点市场。但是,尽管区块链是开放的和令人兴奋的,怀疑者仍然认为其安全性是容易出错的,且程序无法扩展。那些适用于比特币和一些特定的应用程序可能无法为上千种不同的服务及其数百万的用户提供有效的支持。

Though Mr Nakamoto’s subtle design has so far proved impregnable, academic researchers have identified tactics that might allow a sneaky and well financed miner to compromise the block chain without direct control of 51% of it. And getting control of an appreciable fraction of the network’s resources looks less unlikely than it used to. Once the purview of hobbyists, bitcoin mining is now dominated by large “pools”, in which small miners share their efforts and rewards, and the operators of big data centres, many based in areas of China, such as Inner Mongolia, where electricity is cheap.

尽管到目前为止中本聪先生的巧妙设计被证明是坚不可摧的,但学术研究人员已经想出一个可以让一些狡猾且资金充足的矿工在不直接控制 51 % 算力的情况下,让他们向区块链妥协(或让他们乖乖维护区块链)的法子。而且,控制相当一部分网络资源的可能性看上去比以往要小。比特币挖矿曾经是业余爱好者做的事情,如今比特币挖矿已被大型 “ 矿池 ” 占据,小矿工可从中分享他们的努力和回报,这些大数据中心的运营商很多都位于中国,例如电力价格低廉的内蒙古。

Another worry is the impact on the environment. With no other way to establish the bona fides of miners, the bitcoin architecture forces them to do a lot of hard computing; this “proof of work”, without which there can be no reward, insures that all concerned have skin in the game. But it adds up to a lot of otherwise pointless computing. According to blockchain.info the network’s miners are now trying 450 thousand trillion solutions per second. And every calculation takes energy.

另一个担心是对环境的影响。由于没有其他的方法来建立矿工的真诚,比特币体系结构迫使他们进行大量艰苦的运算;这被称为 “ 工作量证明机制 ” ,矿工不挖矿,就没有奖励,从而确保所有相关人员在游戏中都拥有(游戏)皮肤(或从而确保所有相关人员都会参与到这个游戏中)。但是这个过程增加了许多其他毫无意义的计算。根据 blockchain.info 网站提供的信息,全网矿工们现在正在尝试每秒高达 45 万万亿次的解题计算,而每次计算都是需要消耗能源的。

Because miners keep details of their hardware secret, nobody really knows how much power the network consumes. If everyone were using the most efficient hardware, its annual electricity usage might be about two terawatt-hours—a bit more than the amount used by the 150,000 inhabitants of King’s County in California’s Central Valley. Make really pessimistic assumptions about the miners’ efficiency, though, and you can get the figure up to 40 terawatt-hours, almost two-thirds of what the 10m people in Los Angeles County get through. That surely overstates the problem; still, the more widely people use bitcoin, the worse the waste could get.

因为矿工们苦守他们硬件秘密的细节,所以没人真正知道(整个)网络消耗了多少电力。如果每个人都使用最高效的硬件,其每年用电量大约是两万亿瓦时 —— 这比加利福尼亚州中央谷地的金斯县的 15 万居民的用电量还多一点。若对矿工的效率做出非常悲观的假设,你会得到高达 40 万亿瓦时的数字,这几乎是洛杉矶 1,000 万人每年用电量的三分之二。这肯定把问题说严重了;然而,人们使用比特币的范围越广,浪费的情况就越严重。

Yet for all this profligacy bitcoin remains limited. Because Mr Nakamoto decided to cap the size of a block at one megabyte, or about 1,400 transactions, it can handle only around seven transactions per second, compared to the 1,736 a second Visa handles in America. Blocks could be made bigger; but bigger blocks would take longer to propagate through the network, worsening the risks of forking.

然而,比特币(对电力)的消耗也是有限的。因为中本聪先生决定把每个区块的大小限制在 1 MB ,或大约 1,400 笔交易,所以每秒只能处理大约 7 笔交易,相比之下,美国 Visa 公司每秒可处理 1,736 笔。区块可以扩容,但是更大的区块需要更长的时间才能通过网络传播,这会加剧(区块链)分叉的风险。

Earlier platforms have surmounted similar problems. When millions went online after the invention of the web browser in the 1990s pundits predicted the internet would grind to a standstill: eppur si muove. Similarly, the bitcoin system is not standing still. Specialised mining computers can be very energy efficient, and less energy-hungry alternatives to the proof-of-work mechanism have been proposed. Developers are also working on an add-on called “Lightning” which would handle large numbers of smaller transactions outside the blockchain. Faster connections will let bigger blocks propagate as quickly as small ones used to.

早期的平台(或应用)已经克服了类似的问题。在上世纪 90 年代网页浏览器被发明以后,有数以百万计的人访问互联网,专家们预测互联网将陷入停滞状态:但它还在增长( eppur si muove 应为意大利语)。同样地,比特币系统并没有停滞不前。专门挖矿的计算机可以做得很节能,而且已经提出了能耗更少的替代工作量证明机制的方案。开发者也在开发一个名为 “ 闪电网络 ” 的附加组件,它能在区块链以外处理大量的小额交易。更快的连接将允许更大的区块像以往那样快速地传播。

The problem is not so much a lack of fixes. It is that the network’s “bitcoin improvement process” makes it hard to choose one. Change requires community-wide agreement, and these are not people to whom consensus comes easily. Consider the civil war being waged over the size of blocks. One camp frets that quickly increasing the block size will lead to further concentration in the mining industry and turn bitcoin into more of a conventional payment processor. The other side argues that the system could crash as early as next year if nothing is done, with transactions taking hours.

问题不在于缺少改进。正是网络中(出现了不少)的 “ 比特币改进方法 ” 使得很难选择其中一个。协议的变更需要社区的广泛同意,而这些人不是容易达成共识的人。回想一下围绕区块大小展开的内部争论。其中一方阵营担心快速增加的区块大小会导致挖矿行业的进一步中心化,并使比特币向传统的支付厂商靠拢( Ricky 注:只有规模化的大矿工才有可能配备更快速的网络和更先进的矿机,如果区块容量变大,那么小矿工就没有优势了;如果比特币都掌握在大矿工手里,那么比特币跟传统的支付厂商将没有太大的区别)。另一方则认为,如果什么事情都不做,系统最早会在明年崩溃,交易需要数小时(才能完成)。

A break in the battle

Mr Hearn and Gavin Andresen, another bitcoin grandee, are leaders of the big-block camp. They have called on mining firms to install a new version of bitcoin which supports a much bigger block size. Some miners who do, though, appear to be suffering cyber-attacks. And in what seems a concerted effort to show the need for, or the dangers of, such an upgrade, the system is being driven to its limits by vast numbers of tiny transactions.

在争执中的一次突破

Hearn 先生和另一位比特币大亨 Gavin Andresen 先生,他们都是大区块阵营的领导者。他们呼吁矿机公司安装新版本的比特币客户端,以支持更大的区块容量。一些矿工这么做了,然而他们似乎遭受到了网络攻击。而且,似乎为了一起努力表明这种升级的必要性,或(不升级的)危险性,该系统正在被大量微小的交易推到了极限。

This has all given new momentum to efforts to build an alternative to the bitcoin blockchain, one that might be optimised for the storing of distributed ledgers rather than for the running of a cryptocurrency. MultiChain, a build-your-own-blockchain platform offered by Coin Sciences, another startup, demonstrates what is possible. As well as offering the wherewithal to build a public blockchain like bitcoin’s, it can also be used to build private chains open only to vetted users. If all the users start off trusted the need for mining and proof-of-work is reduced or eliminated, and a currency attached to the ledger becomes an optional extra.

这一切都赋予我们新的动力去努力建立一个可以替代比特币区块链的方案,一种经过优化的、可以用来存储数据的分布式账簿,而不是用来运行数字加密货币的分布式账簿。另一家初创公司 Coin Sciences 打造了一个可自主设计区块链的平台 MutiChain ,证明了这个方向是可行的。既可以提供必要的资金来构建像比特币一样的公开区块链,它也可以用于构建仅向经过审查的用户开放的私有链。如果所有用户都开始互相信任,那么就减少或消除了挖矿和工作量证明的需要,依附在账簿上的货币会变得可有可无。

The first industry to adopt such sons of blockchain may well be the one whose failings originally inspired Mr Nakamoto: finance. In recent months there has been a rush of bankerly enthusiasm for private blockchains as a way of keeping tamper-proof ledgers. One of the reasons, irony of ironies, is that this technology born of anti-government libertarianism could make it easier for the banks to comply with regulatory requirements on knowing their customers and anti-money-laundering rules. But there is a deeper appeal.

第一个采用这种衍生区块链的行业很有可能就是那个带有不足之处并最初激励中本聪先生的行业:金融。在最近几个月,作为一种能够保证账簿防篡改的方式,人们对私有区块链的热情高涨。其中的原因是,这诞生自反政府自由主义者的技术可以让银行在知晓它们的客户与反洗钱规则后更好地遵守(政府的)监管要求,这点似乎很讽刺。但这还有一种更深层的吸引力。

Industrial historians point out that new powers often become available long before the processes that best use them are developed. When electric motors were first developed they were deployed like the big hulking steam engines that came before them. It took decades for manufacturers to see that lots of decentralised electric motors could reorganise every aspect of the way they made things. In its report on digital currencies, the Bank of England sees something similar afoot in the financial sector. Thanks to cheap computing financial firms have digitised their inner workings; but they have not yet changed their organisations to match. Payment systems are mostly still centralised: transfers are cleared through the central bank. When financial firms do business with each other, the hard work of synchronising their internal ledgers can take several days, which ties up capital and increases risk.

工业历史学家指出,新的技术通常在被人们发明出来并变得好用这个过程之前就已经可用。在电动机最初被发明出来时,它们部署得像先于它们诞生的大型笨重蒸汽机。制造商花费了数十年才看到他们制造的这些众多分散的(或去中心化的)电动机能重塑人们方方面面的生活。在这次数字货币报告中,英格兰银行在金融领域也看到了同样的曙光。由于廉价的计算,金融公司已将其内部工作数字化,但他们还没有改变他们的组织机构来匹配(数字化)。大多数支付系统仍是中心化的:转账需要通过中央银行进行结算。当金融公司之间进行业务往来时,同步它们内部账簿的沉重工作需要花费几天时间,这个过程会滞留资金并增加风险。

Distributed ledgers that settle transactions in minutes or seconds could go a long way to solving such problems and fulfilling the greater promise of digitised banking. They could also save banks a lot of money: according to Santander, a bank, by 2022 such ledgers could cut the industry’s bills by up to $20 billion a year. Vendors still need to prove that they could deal with the far-higher-than-bitcoin transaction rates that would be involved; but big banks are already pushing for standards to shape the emerging technology. One of them, UBS, has proposed the creation of a standard “settlement coin”. The first order of business for R3 CEV, a blockchain startup in which UBS has invested alongside Goldman Sachs, JPMorgan and 22 other banks, is to develop a standardised architecture for private ledgers.

分布式账簿需要在几分钟或几秒钟内完成交易,对于这个问题分布式账簿还有很长的路要走,这样才能实现数字化银行的更大承诺。它们还可以为银行节省很多开支:据桑坦德银行称,到 2022 年这样的账簿每年能削减掉该行业高达 200 亿美元的账单(或成本)。供应商仍需要证明他们能够处理交易速度远高于比特币的交易,但大银行已经在推动制定新兴技术的标准。其中之一的瑞银集团( UBS )已提出建立一个标准的 “ 结算硬币 ” 。瑞银集团联手高盛、摩根大通和其它 22 家银行投资了区块链初创公司 R3 CEV ,它的首要任务就是开发一个私有账簿的标准架构。

The banks’ problems are not unique. All sorts of companies and public bodies suffer from hard-to-maintain and often incompatible databases and the high transaction costs of getting them to talk to each other. This is the problem Ethereum, arguably the most ambitious distributed-ledger project, wants to solve. The brainchild of Vitalik Buterin, a 21-year-old Canadian programming prodigy, Ethereum’s distributed ledger can deal with more data than bitcoin’s can. And it comes with a programming language that allows users to write more sophisticated smart contracts, thus creating invoices that pay themselves when a shipment arrives or share certificates which automatically send their owners dividends if profits reach a certain level. Such cleverness, Mr Buterin hopes, will allow the formation of “decentralised autonomous organisations”—virtual companies that are basically just sets of rules running on Ethereum’s blockchain.

银行(遇到)的问题并不是独一无二的。各种各样的公司和公共机构都会遇到难以维护的和经常互不兼容的数据库的困扰,还有让它们互相交流(或互相调用)所付出的高额交易成本。这就是以太坊( Ethereum )这个可以说是最雄心勃勃的分布式账簿项目想要解决的问题。以太坊是 21 岁的加拿大编程奇才 Vitalik Buterin 的研发成果,以太坊的分布式账簿能够处理比比特币更多的数据。它还附带了一种编程语言,允许用户编写更复杂的智能合约,如此一来就可以在(买家)接收货物时能够自行付款并创建发票,或者分发证明以便在利润达到一定水平时,会自动向股票持有者发送分红。Buterin 先生希望这种聪明的做法(即以太坊)能够形成 “ 去中心化的自治组织 ” —— 这家虚拟公司(或组织)基本上只是运行在以太坊区块链上的一套规则集。

One of the areas where such ideas could have radical effects is in the “internet of things”—a network of billions of previously mute everyday objects such as fridges, doorstops and lawn sprinklers. A recent report from IBM entitled “Device Democracy” argues that it would be impossible to keep track of and manage these billions of devices centrally, and unwise to to try; such attempts would make them vulnerable to hacking attacks and government surveillance. Distributed registers seem a good alternative.

在众多领域中,这类想法可能会对其中一个领域产生颠覆式影响,它就是 “ 物联网 ” —— 一个由数十亿个以前从不出声的(或从不联网的)日常物品连接而成的网络,例如冰箱、门闩和草坪洒水器。最近 IBM 的一份题为 “ 设备民主 ” 的报告认为,要集中地跟踪和管理数十亿台这样的设备是不可能的,这样的尝试也不明智。这种尝试会使它们容易受到黑客的攻击和政府的监控。分布式登记表似乎是一个不错的选择。

The sort of programmability Ethereum offers does not just allow people’s property to be tracked and registered. It allows it to be used in new sorts of ways. Thus a car-key embedded in the Ethereum blockchain could be sold or rented out in all manner of rule-based ways, enabling new peer-to-peer schemes for renting or sharing cars. Further out, some talk of using the technology to make by-then-self-driving cars self-owning, to boot. Such vehicles could stash away some of the digital money they make from renting out their keys to pay for fuel, repairs and parking spaces, all according to preprogrammed rules.

以太坊提供的可编程性不仅仅允许追踪和记录人们的财产,还允许以各种新的方式被使用。因此,嵌入以太坊区块链中的汽车钥匙可以以各种基于规则的(或基于智能合约的)方式出售或出租,从而实现新型的 P2P 汽车租赁或共享的解决方案。此外,有人提议使用这项技术来制造可自行启动的自动驾驶汽车(或使用这项技术使自动驾驶汽车成为社会公共资源)。这些汽车可以通过出租他们的钥匙赚取一些数字货币并将这些数字货币储存起来,然后再使用这些数字货币来支付燃料、维修和停车的费用,所有这些都是按照预先设定的规则进行的。

What would Rousseau have said?

卢梭会说什么?

( Ricky 注:Jean-Jacques Rousseau ,法国十八世纪启蒙思想家、哲学家、教育家、文学家,民主政论家和浪漫主义文学流派的开创者,启蒙运动代表人物之一;主要著作有《论人类不平等的起源和基础》《社会契约论》《爱弥儿》《忏悔录》《新爱洛伊丝》《植物学通信》等)

Unsurprisingly, some think such schemes overly ambitious. Ethereum’s first (“genesis”) block was only mined in August and, though there is a little ecosystem of start-ups clustered around it, Mr Buterin admitted in a recent blog post that it is somewhat short of cash. But the details of which particular blockchains end up flourishing matter much less than the broad enthusiasm for distributed ledgers that is leading both start-ups and giant incumbents to examine their potential. Despite society’s inexhaustible ability to laugh at accountants, the workings of ledgers really do matter.

不出所料,有些人认为这样的计划过于雄心勃勃。以太坊的创世区块在 8 月份才被挖出,而且以太坊的生态圈有点小,仅有初创公司聚集在其周围。Buterin 先生在最近的一篇博客文章中承认,目前(以太坊的)资金有点短缺( Ricky 注:应该是以太坊创造货币的速度目前有点慢,因为挖矿的人少)。特定区块链(即包括以太坊在内的、除比特币以外的一些数字货币)最终走向繁荣的具体情况,远不及对分布式账簿的广泛热情,这导致初创公司和巨头都在审视它们的潜力。尽管社会有无穷无尽的能力来嘲笑会计师(或尽管社会总是在嘲笑会计师),但是账簿的运作确实很重要。

Today’s world is deeply dependent on double-entry book-keeping. Its standardised system of recording debits and credits is central to any attempt to understand a company’s financial position. Whether modern capitalism absolutely required such book-keeping in order to develop, as Werner Sombart, a German sociologist, claimed in the early 20th century, is open to question. Though the system began among the merchants of renaissance Italy, which offers an interesting coincidence of timing, it spread round the world much more slowly than capitalism did, becoming widely used only in the late 19th century. But there is no question that the technique is of fundamental importance not just as a record of what a company does, but as a way of defining what one can be.

今天的世界深深地依赖于复式记账法。其记录借贷双方的标准化系统对于任何试图了解公司财务状况的人来说都是至关重要的。正如 20 世纪初德国社会学家 Werner Sombart 所说,现代资本主义是否绝对需要这样的记账方式才能发展,这个问题是值得商榷的。虽然这个方法始于文艺复兴时期的意大利商人之间,这提供了一个有趣的时间巧合(或这刚好是个时间巧合),但它在世界各地的传播速度比资本主义慢得多,直到 19 世纪晚期才被广泛使用。但毫无疑问,这种技术至关重要,它不仅仅是作为公司所做事情的记录,而且还能作为一种定义公司能够成为什么的方式。

Ledgers that no longer need to be maintained by a company—or a government—may in time spur new changes in how companies and governments work, in what is expected of them and in what can be done without them. A realisation that systems without centralised record-keeping can be just as trustworthy as those that have them may bring radical change.

账簿不再需要公司或政府来维护,这可能最终会刺激公司或政府在工作方式上做出新的改变,包括对它们(即公司或政府)的期望以及在没有它们(即公司或政府)的情况下可以做什么。认识到没有中心化保存记录的系统可以像拥有它们的系统(即可以中心化保存记录的系统)那样值得信赖,可能会带来根本性的变化。

Such ideas can expect some eye-rolling—blockchains are still a novelty applicable only in a few niches, and the doubts as to how far they can spread and scale up may prove well founded. They can also expect resistance. Some of bitcoin’s critics have always seen it as the latest techy attempt to spread a “Californian ideology” which promises salvation through technology-induced decentralisation while ignoring and obfuscating the realities of power—and happily concentrating vast wealth in the hands of an elite. The idea of making trust a matter of coding, rather than of democratic politics, legitimacy and accountability, is not necessarily an appealing or empowering one.

这样的想法值得期待,一些令人眼花缭乱的区块链仍然是一种新奇的事物,只适用于少数几个小众市场,所以对于它们能扩散和扩大到多大程度,这种怀疑可能是有充分理由的。它们还面临一些可以预料到的反对。一些比特币批评者一直将其视为传播 “ 加州意识形态 ” 的最新技术尝试,加州意识形态是指承诺通过技术来诱导权力的下放(即去集权化)以拯救世界,同时忽视和混淆在权力上真正发生的事情,从而轻易地将大量的财富集中在精英手中。这种想法使用代码来实现信任,而并非法律认可的和有责任的民主政治,这不一定能够吸引人或者取得授权(即得到法律的认可)。

At the same time, a world with record-keeping mathematically immune to manipulation would have many benefits. Evicted Ms Izaguirre would be better off; so would many others in many other settings. If blockchains have a fundamental paradox, it is this: by offering a way of setting the past and present in cryptographic stone, they could make the future a very different place.

与此同时,数学化记账的世界会远离人为的操纵,这会带来很多好处。被驱逐的 Izaguirre 女士会过得更好;其他许多地方的情况也是如此。如果说区块链有一个十分重大的悖论,那就是:通过提供一种无法更改的加密方式记录过去和现在,而最终它却能够让未来变得不一样(Ricky 注:矛盾的地方在于过去和现在是 “ 不变 ” 的,但它却能够 “ 改变 ” 未来)。

参考自:

- 原文:https://www.economist.com/briefing/2015/10/31/the-great-chain-of-being-sure-about-things

- 中文翻译参考自:https://www.8btc.com/article/71956 ,有大量修改

发表评论?